Tax Credit donations allow you to reduce the amount of your tax liability to the state dollar-for-dollar. For example, if you donate $200, your state tax credit will be $200. Your state tax bill will be $200 less when you file your taxes in the spring. Either way, you send dollars directly to the school of your choice (Arizona School for the Arts) instead of the Arizona Revenue Service.

Your Arizona Public School Tax Credit gift to ASA means supporting nearly 40 extracurricular clubs and activities such as Mock Trial, Robotics, Cross Country, Model UN, and character-education programs woven into the ASA student experience. These opportunities build character and leadership and lead to exploring interests beyond the classroom.

Yes, you must be a resident of Arizona to make a tax credit gift.

No, ANY individual or couple who pays Arizona State income tax can contribute!

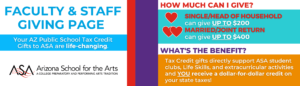

You can take this credit on any tax liability for state income taxes up to $200 on an individual tax return or up to $400 on a joint return. You may donate up to your $200 or $400 limit in recurring gifts during the calendar year, or donate the full amount with a one-time gift.

Yes, maximize your tax credits! You can give to ASA to receive the Public School Tax Credit in addition to taking advantage of three other tax credits in the same year: Private School Tuition Tax Credit, Qualified Charitable Tax Credit, and the Qualified Foster Care Tax Credit.

Unfortunately, we do not have the ability to have donations deducted from paychecks. Instead, we encourage you to set up a recurring donation. You can do so via the online donation form below!

Yes, you will need to complete Form 322; additional information and instructions can be found HERE. The Arizona Department of Revenue now requires taxpayers to report the school’s 9-digit CTDS (County code, Type code, and District code & site code) number on Form 322.

ASA’s CTDS Code is: 07-87-22-001.

Some questions may be best answered by your tax preparer. However, feel free to reach out to the Development Team at development@goasa.org or stop by the Development offices in Main 118 and 117.